The US Justice Department, stung by criticism that it let Wall Street executives off the hook by allowing their employers to pay fines, has now taken off the gloves. New rules issued to prosecutors require them to focus on individual employees in their investigations, which means more executives could spend time in jail.

Read More »

Nedbank CEO Mike Brown says he will challenge a subpoena calling on him to appear at an inquiry relating to the liquidation of Waterkloospruit Projects in 2001, when he was in charge of property finance at BOE Bank, later acquired by Nedbank. BOE picked up 137 stands for R100,000 in what is claimed was a sham auction, according to this article in

Moneyweb.

Read More »

The Concourt handed down a ruling in March that delivers a major blow to lenders. It suspends, once litigation has commenced, the operation of the so-called in duplum rule, which means lenders cannot then charge more than double the outstanding capital on a loan, according to this

article from Werksmans.

Read More »

Jonathan Buckley of Centurion in Pretoria may be the first South African in history to win six judgments against Standard Bank in one day. When the bank failed to comply with the court order compelling it to release documents related to loans he had taken out, he sued the directors for contempt of court.

Read More »

The ANC and Cosatu are threatening "drastic action" over high fees charged by SA's banks. The Democratic Alliance has warned against meddling with "free market forces" which is an odd statement for a sector in which there are just four major players. Hardly a free market at all.

Read More »

Aba's troubles in its mortgage division just got a whole lot worse. Barely two months after losing two similar cases in the South Gauteng High Court, the bank folded before throwing a punch in the Pretoria High Court against two sisters who made startling allegations of fraud and misconduct against the bank.

Read More »

South African banks are about to be hit with an avalanche of legal suits from dispossessed home owners whose properties were sold in execution at a fraction of their market value. They are arguing that this violates their Constitutional rights to property and fair administrative justice.

Read More »

Durban-based Nav Chan started questioning FNB's eBucks rewards calculations. Weeks later his accounts were cancelled and he found himself listed on a secretive banking database operated by SA Fraud Prevention Services. Suddenly, his business started to take a dive.

Read More »

Banks are resorting to grabbing money out of customers' accounts in settlement of debts but this is soon to become illegal. Here's how to handle the situation, according to Wendy Knowler at Consumer Watch.

Read More »

An inquiry into the demise of African Bank is likely to turn some stones and reveal some worms. The last major inquiry into a banking collapse involved Regal, by the same Advocate John Myburgh who has been asked to look into African Bank. His brief is to investigate reckless behaviour, possible fraud and negligence.

Read More »

Standard Bank has denied allegations of reckless lending to companies involved in so-called "reverse mortgage schemes." Borrowers using this system found they had to pay back up to six times the loan amount, and had title of their houses transferred to the credit provider.

Read More »

Absa bank was handed a stunning defeat in the South Gauteng High Court last week when it attempted to obtain summary judgment against two home owners. The judge argued that Absa's failure to produce the original loan agreements - which the bank says was destroyed in a fire - meant the matter has to go to trial.

Read More »

Johannesburg businessman Damon Greville defended himself in the South Gauteng High Court this week against Sasfin Bank, which liquidated his 67 year-old business in 2012 and is now attempting to repossess his house. The judge found "substantive evidence" that the bank's legal standing was in question after Greville presented evidence of securitisation and bogus accounting by the bank.

Read More »

For a disturbing insight into modern banking ethics, look no further than the case of Royal Bank of Scotland and its "business turnaround" division called Global Restructuring Group. South African banking customers would be well advised to pay attention to this case.

Read More »

Technology has leapfrogged the banking sector, rendering it as obsolete as the buggy whip. So why are we handing over 9% of the economy to an obsolete parasite, asks Charles Hugh Smith.

Read More »

In Part 2 of our interview with Robyn Zimmerman, a consumer lawyer based in Cape Town, we look at what legal ammunition consumers can bring to their defence in cases where their homes are under threat of repossession, and we look at the fascinating case of Samsodien versus First National Bank.

Read More »

South Africa's courts have traditionally weighed in on the side of the banks when it comes to home repossession, even though the loans have been securitised and are now under new ownership. But the tide is turning against the banks, says consumer lawyer, Robyn Zimmerman.

Read More »

The government has swept aside objections from the banking industry and decided to force credit bureaus to remove adverse credit information on 1,6 million South Africans - many of them public servants - who have been blacklisted but have paid off their debts. The move has been labelled a "vote catching" exercise ahead of next year's elections.

Read More »

The entire executive board of HSH Nordbank in Germany face up to 10 years in prison if found guilty of breaching trust. This is one of several trials involving bankers in Europe, and reflects mounting fury over the conduct of banks leading up to the financial crisis in 2008.

Read More »

A new report by a UK parliamentary committee recommends jail time for bankers found guilty of reckless misconduct.

Read More »

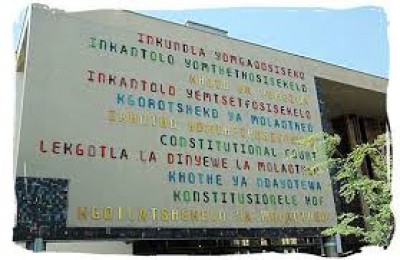

Billionaire entrepreneur Mark Shuttleworth, who emigrated from SA in 2001, has brought an order before the Constitutional Court seeking to have exchange controls declared unconstitutional.

Read More »

In this interview with NewERA's legal advisor, Raymondt Dicks, we ask whether the securitisation scandal as it has come to be known around the world is the biggest fraud in history. We also find out what's next for NewERA in light of a recent High Court judgement that appears to have energised the group's campaign to stop SA banks foreclosing on securitised loans.

Read More »

A judgement isssued last week in the South Gauteng High Court could open up a world of trouble for the banks. The verdict appears to buttress NewERA's claim that banks engaged in securitisation activities are violating statutes left and right, writes Arlene Levy.

Read More »

The New Economic Rights Alliance (NewEra) has lodged a complaint with the National Credit Regulator (NCR) calling on it to force the major banks to disclose details of their securitisation transactions, which are reckoned to exceed R20 billion a month, writes Arlene Levy.

Read More »

The US Justice Department, stung by criticism that it let Wall Street executives off the hook by allowing their employers to pay fines, has now taken off the gloves. New rules issued to prosecutors require them to focus on individual employees in their investigations, which means more executives could spend time in jail.

The US Justice Department, stung by criticism that it let Wall Street executives off the hook by allowing their employers to pay fines, has now taken off the gloves. New rules issued to prosecutors require them to focus on individual employees in their investigations, which means more executives could spend time in jail.

Jonathan Buckley of Centurion in Pretoria may be the first South African in history to win six judgments against Standard Bank in one day. When the bank failed to comply with the court order compelling it to release documents related to loans he had taken out, he sued the directors for contempt of court.

Jonathan Buckley of Centurion in Pretoria may be the first South African in history to win six judgments against Standard Bank in one day. When the bank failed to comply with the court order compelling it to release documents related to loans he had taken out, he sued the directors for contempt of court.  The ANC and Cosatu are threatening "drastic action" over high fees charged by SA's banks. The Democratic Alliance has warned against meddling with "free market forces" which is an odd statement for a sector in which there are just four major players. Hardly a free market at all.

The ANC and Cosatu are threatening "drastic action" over high fees charged by SA's banks. The Democratic Alliance has warned against meddling with "free market forces" which is an odd statement for a sector in which there are just four major players. Hardly a free market at all.

Aba's troubles in its mortgage division just got a whole lot worse. Barely two months after losing two similar cases in the South Gauteng High Court, the bank folded before throwing a punch in the Pretoria High Court against two sisters who made startling allegations of fraud and misconduct against the bank.

Aba's troubles in its mortgage division just got a whole lot worse. Barely two months after losing two similar cases in the South Gauteng High Court, the bank folded before throwing a punch in the Pretoria High Court against two sisters who made startling allegations of fraud and misconduct against the bank.  South African banks are about to be hit with an avalanche of legal suits from dispossessed home owners whose properties were sold in execution at a fraction of their market value. They are arguing that this violates their Constitutional rights to property and fair administrative justice.

South African banks are about to be hit with an avalanche of legal suits from dispossessed home owners whose properties were sold in execution at a fraction of their market value. They are arguing that this violates their Constitutional rights to property and fair administrative justice.

Durban-based Nav Chan started questioning FNB's eBucks rewards calculations. Weeks later his accounts were cancelled and he found himself listed on a secretive banking database operated by SA Fraud Prevention Services. Suddenly, his business started to take a dive.

Durban-based Nav Chan started questioning FNB's eBucks rewards calculations. Weeks later his accounts were cancelled and he found himself listed on a secretive banking database operated by SA Fraud Prevention Services. Suddenly, his business started to take a dive.  Banks are resorting to grabbing money out of customers' accounts in settlement of debts but this is soon to become illegal. Here's how to handle the situation, according to Wendy Knowler at Consumer Watch.

Banks are resorting to grabbing money out of customers' accounts in settlement of debts but this is soon to become illegal. Here's how to handle the situation, according to Wendy Knowler at Consumer Watch. An inquiry into the demise of African Bank is likely to turn some stones and reveal some worms. The last major inquiry into a banking collapse involved Regal, by the same Advocate John Myburgh who has been asked to look into African Bank. His brief is to investigate reckless behaviour, possible fraud and negligence.

An inquiry into the demise of African Bank is likely to turn some stones and reveal some worms. The last major inquiry into a banking collapse involved Regal, by the same Advocate John Myburgh who has been asked to look into African Bank. His brief is to investigate reckless behaviour, possible fraud and negligence. Standard Bank has denied allegations of reckless lending to companies involved in so-called "reverse mortgage schemes." Borrowers using this system found they had to pay back up to six times the loan amount, and had title of their houses transferred to the credit provider.

Standard Bank has denied allegations of reckless lending to companies involved in so-called "reverse mortgage schemes." Borrowers using this system found they had to pay back up to six times the loan amount, and had title of their houses transferred to the credit provider. Absa bank was handed a stunning defeat in the South Gauteng High Court last week when it attempted to obtain summary judgment against two home owners. The judge argued that Absa's failure to produce the original loan agreements - which the bank says was destroyed in a fire - meant the matter has to go to trial.

Absa bank was handed a stunning defeat in the South Gauteng High Court last week when it attempted to obtain summary judgment against two home owners. The judge argued that Absa's failure to produce the original loan agreements - which the bank says was destroyed in a fire - meant the matter has to go to trial. Johannesburg businessman Damon Greville defended himself in the South Gauteng High Court this week against Sasfin Bank, which liquidated his 67 year-old business in 2012 and is now attempting to repossess his house. The judge found "substantive evidence" that the bank's legal standing was in question after Greville presented evidence of securitisation and bogus accounting by the bank.

Johannesburg businessman Damon Greville defended himself in the South Gauteng High Court this week against Sasfin Bank, which liquidated his 67 year-old business in 2012 and is now attempting to repossess his house. The judge found "substantive evidence" that the bank's legal standing was in question after Greville presented evidence of securitisation and bogus accounting by the bank. For a disturbing insight into modern banking ethics, look no further than the case of Royal Bank of Scotland and its "business turnaround" division called Global Restructuring Group. South African banking customers would be well advised to pay attention to this case.

For a disturbing insight into modern banking ethics, look no further than the case of Royal Bank of Scotland and its "business turnaround" division called Global Restructuring Group. South African banking customers would be well advised to pay attention to this case. Technology has leapfrogged the banking sector, rendering it as obsolete as the buggy whip. So why are we handing over 9% of the economy to an obsolete parasite, asks Charles Hugh Smith.

Technology has leapfrogged the banking sector, rendering it as obsolete as the buggy whip. So why are we handing over 9% of the economy to an obsolete parasite, asks Charles Hugh Smith.

South Africa's courts have traditionally weighed in on the side of the banks when it comes to home repossession, even though the loans have been securitised and are now under new ownership. But the tide is turning against the banks, says consumer lawyer, Robyn Zimmerman.

South Africa's courts have traditionally weighed in on the side of the banks when it comes to home repossession, even though the loans have been securitised and are now under new ownership. But the tide is turning against the banks, says consumer lawyer, Robyn Zimmerman. The government has swept aside objections from the banking industry and decided to force credit bureaus to remove adverse credit information on 1,6 million South Africans - many of them public servants - who have been blacklisted but have paid off their debts. The move has been labelled a "vote catching" exercise ahead of next year's elections.

The government has swept aside objections from the banking industry and decided to force credit bureaus to remove adverse credit information on 1,6 million South Africans - many of them public servants - who have been blacklisted but have paid off their debts. The move has been labelled a "vote catching" exercise ahead of next year's elections. The entire executive board of HSH Nordbank in Germany face up to 10 years in prison if found guilty of breaching trust. This is one of several trials involving bankers in Europe, and reflects mounting fury over the conduct of banks leading up to the financial crisis in 2008.

The entire executive board of HSH Nordbank in Germany face up to 10 years in prison if found guilty of breaching trust. This is one of several trials involving bankers in Europe, and reflects mounting fury over the conduct of banks leading up to the financial crisis in 2008. A new report by a UK parliamentary committee recommends jail time for bankers found guilty of reckless misconduct.

A new report by a UK parliamentary committee recommends jail time for bankers found guilty of reckless misconduct. Billionaire entrepreneur Mark Shuttleworth, who emigrated from SA in 2001, has brought an order before the Constitutional Court seeking to have exchange controls declared unconstitutional.

Billionaire entrepreneur Mark Shuttleworth, who emigrated from SA in 2001, has brought an order before the Constitutional Court seeking to have exchange controls declared unconstitutional. In this interview with NewERA's legal advisor, Raymondt Dicks, we ask whether the securitisation scandal as it has come to be known around the world is the biggest fraud in history. We also find out what's next for NewERA in light of a recent High Court judgement that appears to have energised the group's campaign to stop SA banks foreclosing on securitised loans.

In this interview with NewERA's legal advisor, Raymondt Dicks, we ask whether the securitisation scandal as it has come to be known around the world is the biggest fraud in history. We also find out what's next for NewERA in light of a recent High Court judgement that appears to have energised the group's campaign to stop SA banks foreclosing on securitised loans.  A judgement isssued last week in the South Gauteng High Court could open up a world of trouble for the banks. The verdict appears to buttress NewERA's claim that banks engaged in securitisation activities are violating statutes left and right, writes Arlene Levy.

A judgement isssued last week in the South Gauteng High Court could open up a world of trouble for the banks. The verdict appears to buttress NewERA's claim that banks engaged in securitisation activities are violating statutes left and right, writes Arlene Levy.